Basics of Neural Networks

Neural networks, in the world of finance, assist in the development of such process as time-series forecasting, algorithmic trading, securities classification, credit risk modeling and constructing proprietary indicators and price derivatives.

A neural network works similarly to the human brain’s neural network. A “neuron” in a neural network is a mathematical function that collects and classifies information according to a specific architecture. The network bears a strong resemblance to statistical methods such as curve fitting and regression analysis.

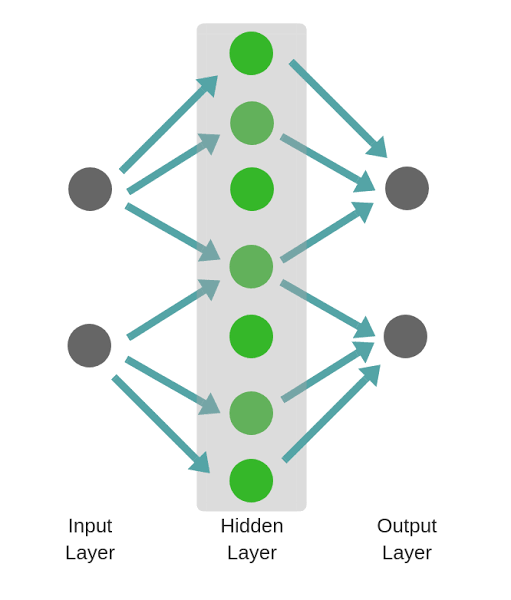

A neural network contains layers of interconnected nodes. Each node is a perceptron and is similar to a multiple linear regression. The perceptron feeds the signal produced by a multiple linear regression into an activation function that may be nonlinear.

In a multi-layered perceptron (MLP), perceptrons are arranged in interconnected layers. The input layer collects input patterns. The output layer has classifications or output signals to which input patterns may map. For instance, the patterns may comprise a list of quantities for technical indicators about a security; potential outputs could be “buy,” “hold” or “sell.”

Hidden layers fine-tune the input weightings until the neural network’s margin of error is minimal. It is hypothesized that hidden layers extrapolate salient features in the input data that have predictive power regarding the outputs. This describes feature extraction, which accomplishes a utility similar to statistical techniques such as principal component analysis.